Under the long-term suppression of the COVID-19 pandemic, offline services have been significantly impacted, while the online digital industry has embraced development opportunities. Among them, the innovation, competition, and market prospects of digital technology are at an unprecedented level. Among many digital technologies, the "metaverse" stands out for its ability to attract investment.According to McKinsey's latest report, "Value Creation in the Virtual World," global interest in the metaverse's vertical sectors surged in 2022, with Web3 investment news and new NFT product lines being launched almost every week. By early July, over $120 billion had been invested in the metaverse, more than twice the $57 billion investment in 2021.This article will explore how the semiconductor industry can leverage the "metaverse" as a double-edged sword, focusing on technological innovation, industrial development, and application expansion.Is the end of AI AIoT, and the end of the internet the metaverse?

The concept of the metaverse first appeared in 1992 in Neal Stephenson’s science fiction novel Snow Crash. The novel describes a virtual digital world "Metaverse" parallel to the real world, where people use VR devices to create avatars and live in the virtual world. This concept became popular in later novels and films.Even today, the metaverse lacks a unified and clear definition, but there are common elements that help understand this popular concept.The most widely accepted is Roblox’s "8 Essential Elements of the Metaverse": Identity, Friends, Immersion, Low Latency, Diversity, Ubiquity, Economic System, and Civilization. Roblox, the world’s largest multiplayer online creation platform, went public in the US on March 11, 2021, and is considered the "first stock of the metaverse."Facebook founder Mark Zuckerberg likens the metaverse to an internet that humans can “immerse themselves in” rather than just “watch and use” (UGC ecosystem), not just the next generation of the internet but the ultimate one. On October 28, 2021, Facebook changed its name to Meta, fully investing in the metaverse and sparking the "metaverse boom" among major tech giants, becoming the catalyst for the metaverse economy’s explosion.In the "2022 China Metaverse White Paper," the metaverse is defined as a digital world created by people using computers, parallel to the real world. It refines the "four core features of the metaverse" (Figure 1): Immersive experience, Virtual identity, Virtual economy, and Virtual social governance. This report, released in May 2022, is the most authoritative and comprehensive metaverse report in China.Although there are many valuable viewpoints in the global debate, it can be summarized that the future of the metaverse should encompass keywords like "virtual and real integration, immersive experience, ecological closed loop, natural interaction, parallel execution, and the Internet of Everything."Another hot topic is whether the metaverse is the future of the internet. The radicals believe that the metaverse is the next generation of mobile computing platforms (such as VR/AR/XR devices) that will create an entirely new internet ecosystem, with 5 billion users expected by 2030. Gradualists argue that the metaverse is not the next generation of the internet; it is a new application that will emerge once technology reaches a certain level and will be the largest application scenario in the third generation of the internet, following the PC and mobile internet.Interestingly, different countries and regions have different attitudes toward the metaverse, divided into radical and cautious factions. Countries like South Korea, Japan, and India are in the radical camp, while the U.S., Europe, and China are more cautious or wait-and-see.Attitudes Toward the Metaverse's Prospects in Different Countries

The South Korean government reacted quickly to the metaverse, setting up a metaverse association and aiming to take a leading role in the industry. According to the five-year "Metaverse Seoul Basic Plan," the metaverse platform "Metaverse Seoul" is expected to be completed by the end of 2022.Japan aims to foster metaverse-related industries and build new national advantages. The Ministry of Economy, Trade, and Industry published a report in July 2021 defining the metaverse as "a virtual space where producers from various fields provide services and content to consumers."India is one of the top countries in the world for metaverse investment, with major tech companies like Reliance Industries, which launched "Jio Glass" for students and teachers to access 3D virtual classrooms.In contrast, developed countries like the U.S. remain cautious. The U.S. government has not yet released an official metaverse policy, with concerns over data security and monopolistic risks taking precedence. Europe is also highly cautious, with the EU focusing on regulations to gain a first-mover advantage in governance.China, on the other hand, has been more lenient with new technologies and is allowing space for the metaverse to grow. Currently, there is no official metaverse policy, although articles, such as one from the Central Commission for Discipline Inspection in December 2021, view the metaverse as a combination and upgrade of existing technologies, likening it to a "3D version of the internet."Strategies of Major Tech Companies

Under varying national attitudes, global tech companies also show similar and divergent approaches toward the metaverse.The commonality is that tech giants are primarily focused on expanding capabilities in VR/AR hardware, 3D game engines, and content creation platforms. While the specific choices vary, the sub-sectors are quite similar with no major new applications emerging yet. The differences arise from the companies’ stances on the metaverse, with "radical" and "gradual" factions."Radical" companies include Roblox, Meta, Microsoft, Google, Nvidia, Baidu, NetEase, etc. These companies, mostly large American enterprises, are investing heavily in the metaverse, with some already launching metaverse-related products.For example, NetEase unveiled its next-gen internet technology architecture for the metaverse in December 2021, releasing its virtual human SDK "Youling" and immersive event system "Yaotai," showcasing their metaverse muscles. Similarly, Baidu launched "Xirang," an immersive virtual space parallel to the physical world, as part of its metaverse project initiated in December 2020."Gradual" companies like Tencent, ByteDance, and Alibaba have not officially announced major metaverse layouts but are quietly making moves in metaverse sub-sectors.Currently, Tencent is focusing on three main areas: underlying infrastructure, backend architecture, and content & scenarios. It is investing in Epic Games and Snap to establish a strong position in the VR/AR ecosystem. Alibaba has invested heavily in Sandbox and established a metaverse lab within Alibaba DAMO Academy to explore four layers of the metaverse: holographic construction, 3D simulation, virtual-real integration, and linking the virtual with the real. ByteDance, the parent company of TikTok, has also entered the metaverse through acquisitions, including purchasing VR headset maker Pico for 9 billion yuan.Analyzing the Metaverse Industry Chain

From a technological evolution perspective, the metaverse needs to go through three development stages: Digital Twin, Digital Native, and Virtual-Real Symbiosis. Currently, it is still in its early stage, with VR and AR devices serving as initial mediums. Accelerating the speed of metaverse technology development requires the collective strength of the entire industry chain.The metaverse industry chain has already gathered a wide range of upstream, midstream, and downstream companies.Upstream: Core Technologies

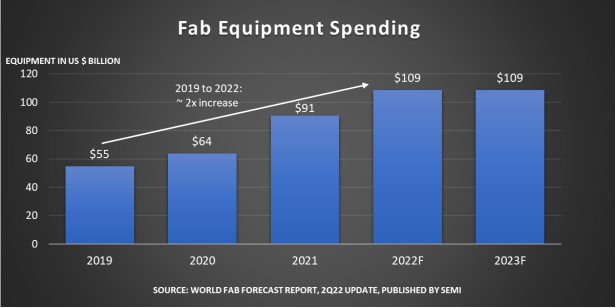

Core technologies include hardware components, foundational software, and network technologies. Hardware component industries such as core chips, optical devices, displays, and sensors will directly affect the autonomy of domestic terminal industries. For example, GPUs, MCUs, and sensors must improve performance to meet the algorithm requirements of the metaverse.Midstream: Platform Technologies

The metaverse requires platform technology companies that provide essential services to the application ecosystem. These companies are categorized into three main areas: digital twins, creative tools, and IT support platforms.Downstream: Products and Ecosystem

The downstream sector of the metaverse industry is diverse, including XR devices, interactive technologies, and simulation. These products, along with games, social media, advertising, and other sectors, will drive the metaverse forward.Chinese Semiconductor Companies' Involvement in the Metaverse

Chinese semiconductor companies are playing a key role in the metaverse’s development, as evidenced by the "2022 Hurun China Metaverse Potential Companies List." Of the 220 companies on the list, 36 (16%) are semiconductor-focused, second only to software and data services (17%) and media & entertainment (17%).The AR/VR chip sector, which is essential for the metaverse, includes companies like MediaTek, Airoha Electronics, Beijing Junzheng, Rockchip, Allwinner Technology, and Chipone Technology, showing that Chinese semiconductor firms are making strides in the AR/VR applications that power the metaverse.The optical, display, and interaction technologies—key components for metaverse devices—are also being developed by prominent Chinese companies like Leyard, OFILM, Sunny Optical, and BOE. These companies are focused on providing a complete set of solutions to drive the rapid development of metaverse applications.Lastly, in the semiconductor and electronic component sectors, companies are deeply developing specific chip technologies and expanding product lines to provide solutions for the innovation and application of metaverse products.